Financial services is complicated.

Your CX can’t be.

Design smoother customer journeys with less friction to drive deposits, lower operating costs and deepen relationships.

CX orchestration platform built for

financial services

financial services

76% of business banking customers have abandoned onboarding a product or service.

They told us the problems. So we fixed them!

They told us the problems. So we fixed them!

Banking CX problems we solve

Responsible for partner CX you can't see

Solution: Ecosystem Connectors

• Connect partners, providers, teams.

• Real-time data sharing in one place.

• Syncs with banking systems: Fiserv, FIS, Salesforce, Microsoft Dynamics and more.

• Pre-built, plug and play.

• No rigid data formats or complicated implementation.

• Strong service governance minimizes third-party risk.

• Connect partners, providers, teams.

• Real-time data sharing in one place.

• Syncs with banking systems: Fiserv, FIS, Salesforce, Microsoft Dynamics and more.

• Pre-built, plug and play.

• No rigid data formats or complicated implementation.

• Strong service governance minimizes third-party risk.

Slow onboarding or customer churn

AI-powered insights and Journey Builder

• Build and adjust journeys without code. Remove friction in real time.

• Agility without tech burden.

• Include partner journey steps.

• Share journey timeline to keep customers updated at all times.

• Own your branded experience.

• Improve journey success with AI insights. Solution:

• Build and adjust journeys without code. Remove friction in real time.

• Agility without tech burden.

• Include partner journey steps.

• Share journey timeline to keep customers updated at all times.

• Own your branded experience.

• Improve journey success with AI insights. Solution:

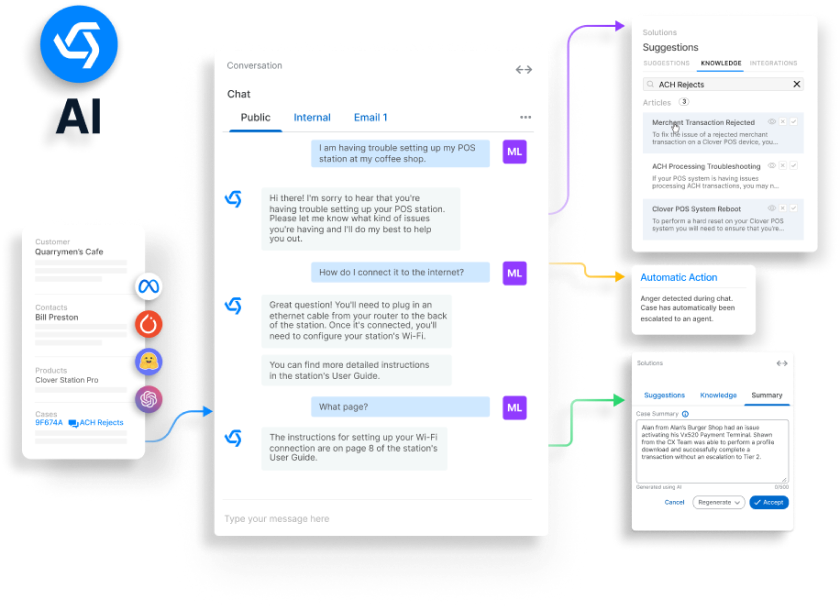

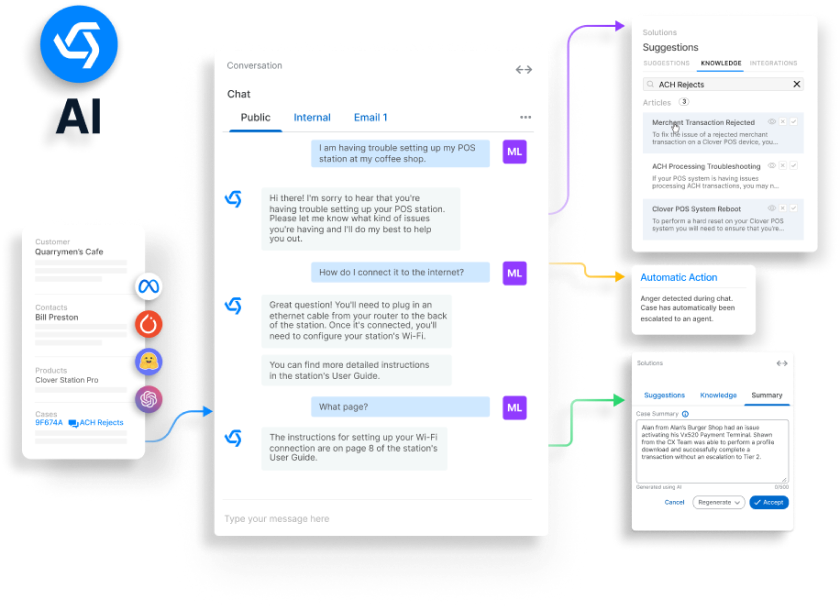

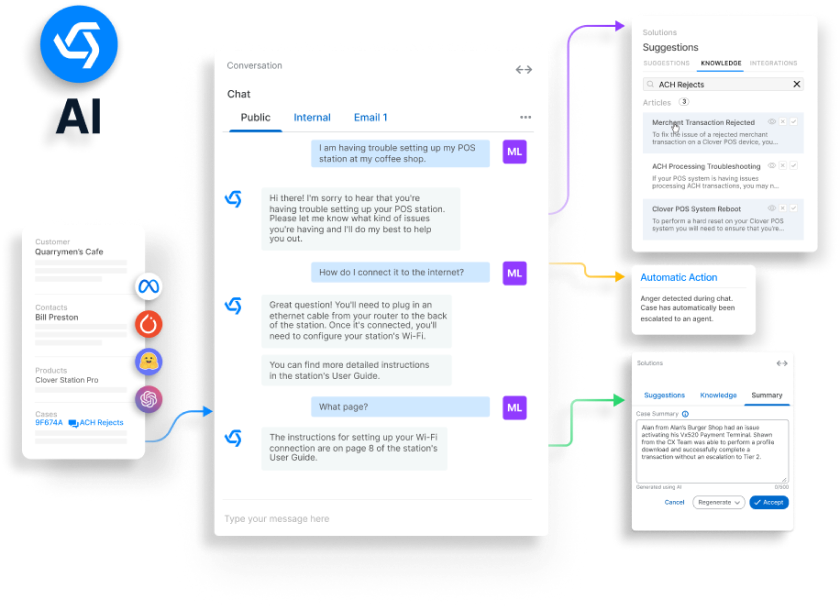

Growing support costs and volume

Solution: Ecosystem, Journeys and More CXM Tools

• CX tools to help customers faster

• Empower teams and minimize effort.

• AI Assist, Summarizations, and Knowledge Delivery by prompt.

• AI insights you can’t find anywhere else.

• CX tools to help customers faster

• Empower teams and minimize effort.

• AI Assist, Summarizations, and Knowledge Delivery by prompt.

• AI insights you can’t find anywhere else.

Learn how KeyBank optimized its CX using OvationCXM

Read case studyFinancial services use cases

Commercial Banking

Treasury management, merchant, commercial card, deposits and lending.

• Buying & sales

• Activation & onboarding

• Commercial account servicing

• Buying & sales

• Activation & onboarding

• Commercial account servicing

Wealth Management

Improved business performance for advisors and clients.

• New account opening

• Client onboarding

• Portfolio servicing requests

• New account opening

• Client onboarding

• Portfolio servicing requests

Corporate Investment Banking

Focus on deal execution lifecycle.

• Deal screening

• Due diligence & deal execution

• Post-deal integration

• Deal screening

• Due diligence & deal execution

• Post-deal integration

Claims Processing

Improved business process and performance.

• Optimized claim processing

• Emergency claim resolution

• Intelligent workflows

• Optimized claim processing

• Emergency claim resolution

• Intelligent workflows

Customer Service

Enable employees to deliver knowledge and personalized information to customers

• New customer onboarding

• Policy/terms and conditions amendments

• Employee enablement

• New customer onboarding

• Policy/terms and conditions amendments

• Employee enablement

Third-Party Engagement

Streamline operations through shared visibility.

• Shared view of the customer

• Ecosystem collaboration

• Report & investigate claims

• Shared view of the customer

• Ecosystem collaboration

• Report & investigate claims

Orchestrate more profitable and streamlined customer

journeys.

Request a demoReceive monthly CX tips and

updates

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Platform

© 2024 OvationCXM. All rights reserved.

OvationCXM, DBA of Boomtown Network Inc.

(1).png)

.png)